For our latest Journalist’s Insights webinar, we spoke to Douglas Mackenzie from Fintech Finance. We had met Doug at Fintech Inn in Lithuania at the end of last year, and saw him in action interviewing some of the Baltic nation’s top government officials and stakeholders in fintech there. Doug travels the world interviewing the most significant banking players and hottest fintech startups, something that gives him the unique ability to join the dots of the global fintech story like few other fintech journalists.

We decided to swap roles and put Doug on the hot seat, as he likes to say. We wanted to see how much insight we could get from him, not only when it comes to fintech, but also his role as producer and host. We had previously interviewed digital journalists focusing on the written word. Doug produces and hosts a number of videos he needs to get (time-poor, C-level exec) guests for, something that is logistically challenging and which even forces him to ‘pitch’ people to come on as guests.

Check out our conversation with Doug:

Index

- What it means to be a host and producer

- Doug’s day to day (before Covid)

- How Doug manages to get people on his show

- Difference in storytelling between video shows and typical written articles

- How fintech journalism came about

- How Doug got into fintech journalism

- What is fintech? Where do you find ‘it’?

- Covid, digitisation and fintech

- How China is a unique case in fintech

- Fintech in the Baltics

- Fintech in Western Europe

- Why Doug sees Brazil and China as two of the most interesting fintech geographies, together with the UK

- Fintech and Brexit

- What lies ahead for fintech in the short term

- How Doug gets pitched via email, LinkedIn and WhatsApp

- What stories Doug looks out for

- How non-UK fintech startups can get noticed in Fintech Finance and the UK fintech media

- Q&A: Why fintech journalism is so concentrated in London

- Q&A: Doug’s take on why British challenger banks don’t have it easy in the US

- Q&A: Doug’s thoughts on open banking

- Q&A: Doug’s favourite interview

- Q&A: Doug’s next destinations once lockdown is over

- Staying in touch with Doug and the latest from Fintech Finance

Hi Doug, thank you for joining us. It’s great having you here.

Doug Mackenzie: Thank you for having me. It was a brilliant trip when I went over to Lithuania to see the fintech over there and absolutely loved it, so thank you for having me once again in the webinar.

Thank you. So let’s start with the questions.

You’re host and producer at Fintech Finance. Could you tell us a little bit what it means to be a producer of videos, and expand on the different series that you produce at Fintech Finance?

Doug Mackenzie: My role at Fintech Finance is pretty expansive. Being a producer covers so many different facets when it comes to fintech, and that was before Covid even changed all of that. Before Covid we would typically run three to five in-depth documentaries a month on a particular financial services topic. They would range anywhere from insurtech, wealth management, KYC.

We go into all kinds of different issues. We get a number of different speakers and it would be my job to make sure we would feature speakers from reputable banks, tech companies, and put them together. Once I have that, I work on a script that ties them all together and creates a singular back and forth between all three participants. We would typically have three participants within one episode.

In our latest show, for instance, just before Covid, we went to Mexico. We got Galileo, an ecosystem provider, then we got Klar, a startup bank there, probably one of the most exciting startup banks in Latin America, and then we had Belvo, a company that helps open up APIs for banks.

Doug in Mexico

We typically put the interviews together into one video and get some nice B-roll to bring it together and make it exciting. That is the issue, and one of the main differences between a writer and the producer. You need to look at the visual aspect, as well as make it an interesting story. So that’s where I spend a lot of my time. Fintech can be dry if you want it to be. So visually you need to work hard to get something different out of it.

What was your day-to-day like normally, before Covid?

Doug Mackenzie: We typically travel twice a week to different countries. And we interview. Interviews normally take us around 45 minutes. We set up filming at their offices. We would normally film at their offices so we can get a feel for them on the video, get their logos and all that.

After filming I would come back and work on getting the guests for the next episodes booked in. We typically look at C-suite executives from banks to fit in the episode and then write a script for it.

As a result I get to talk with a lot of press teams within a lot of different banks, but also lots of different tech companies who’d like to be in the episodes too. So my day to day would typically include being on the phone, trying to get these very time-poor people on camera.

A lot of people actually don’t like being on camera, especially if they’re not trained to be on camera. So, I do my best to try to get them on the show. The rest of the day I write scripts for various different interviews, and send feedback and previous videos to people that were interviewed.

I can imagine a lot of people are hard to convince, as you mentioned they might be lacking the confidence or media training, or because they are so time-poor. Not that they don’t see the value, but they might not want to do it.

So how do you pull those miracles when it gets really hard to get someone to be interviewed?

Doug Mackenzie: It requires a lot of back and forth with press and marketing teams. We’re nice when it comes to video editing. We offer the chance to look over the video and make sure we give the chance to remove anything that sounds wrong or was said in a way that was not intended. So they get a chance to look over once more and make sure that the product is along the lines of their PR.

Another difference that I see between writing and producing in fintech and having watched your shows. In fintech there’s a lot of announcements, be it investment, or new products or features. They seem like different stories altogether. With producing also the process of is different, as you mention.

Doug Mackenzie: At the end of the day, it’s an issue with the fintech industry as a whole. It’s often product-led rather than story-led. As a result you have to look at a product. If the product has some legs and is going to go on for a long time, then that is a key part of what we look for.

Often, our episodes focus on very broad topics and issues and challenges that banks are seeing. That’s what we typically would look to focus on. We will have banks describe the challenges they have, what they have been working on. The tech companies can do a bit of both by saying ‘this is how we help the banks’ but also show how they are different to banks. Recently we’ve had the banks coming out on top when it comes to catching up to these tech companies.

I always wish that there would be more stories in fintech. I’m starting to see more as fintech drifts into charity work and especially with Covid. The way fintech itself has helped a lot of people during this time, especially when it comes to payments. Or being able to be lent to, lendtech. There’s finally some really exciting stories out there. I’m excited for the state of fintech and where it will go when it comes to newsworthiness.

Let’s zoom out of your role a bit. Fintech is a hot topic, but it’s also a relatively new ‘industry’. Could you tell us how fintech journalism came about, and how you realised you wanted to be a part of this industry?

Doug Mackenzie: I’ve only been in the industry for half a decade, now. To coin a phrase you used earlier, there are some ‘big dogs’ in the media side of things. You’ve got TechCrunch, who have been around for about 15 years, as well as a few others.

I think there’s a two-pronged approach about how fintech journalism came about. Half of it came from the tech side of things. Like we said, outlets like TechCrunch. Finance drifted into that. And the other side, from what I can gather, really started out of consultancy work. For instance everyone looks towards 11:FS, who have not only established speakers from their own organisation but also the interaction with the banks and others on a daily basis, that creates that brand interest and ramps up a lot of views.

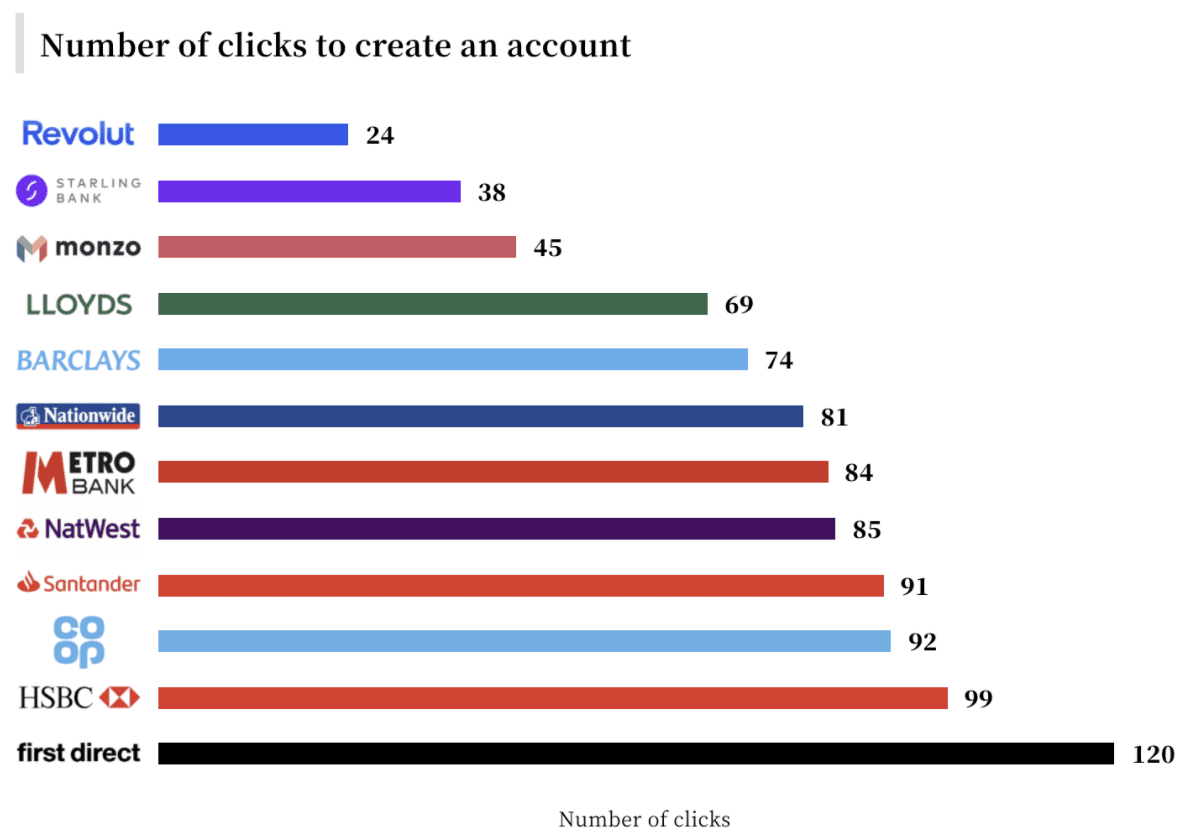

I think that is really where fintech journalism started, and then as it became increasingly democratised and people realised they can get a Monzo on their phones and onboard themselves in a new bank within something like 45 clicks, I think it was, then obviously more people started to get involved.

This image has gone viral in social media recently. Credit: Built for Mars

What did you do before joining fintech finance? Was it a gradual move into fintech journalism from what you were doing previously?

Doug Mackenzie: I had just come back from teaching at a university in central China. On my phone, I had apps like WeChat and within that I was able to book my flights when I went on holiday. I was able to book my train tickets. I was on 4G, messaging my friends who still had 3G.

I assumed everyone had the equivalent of WeChat in the UK. I found it very interesting that you couldn’t pay on WhatsApp when I came back. WeChat is obviously a wallet as well, so that’s where I really first found out about fintech.

When I came back I actually saw an advert in my hometown where my boss, Ali Paterson, had put out an advert saying “Need someone who loves to travel and is pretty good at being busy all the time”. So I jumped on it, not really knowing what it would entail. Five years later, here I am. Before Covid, flying around the world, interviewing banks in what felt like every country in the world.

A lot of people assume fintech is about, or involves, only startups. Others say fintech is, or will be, absolutely everywhere. How do you define fintech? Where or what is it?

Doug Mackenzie: It’s a good question. I wish it was more prevalent. I still go to a lot of my friends and tell them about these innovations and they are either not relevant or have not heard of them.

I find it interesting that despite finance being such an important part of everyone’s lives, it’s still not an everyday talking point. I don’t know if that due to our culture in the UK. It’s very awkward to talk about money. That’s a major hurdle. Nobody wants to talk about money, nobody wants to talk about how much they have or they would like to make, especially in polite conversation, it’s not something you would talk about at the pub, typically.

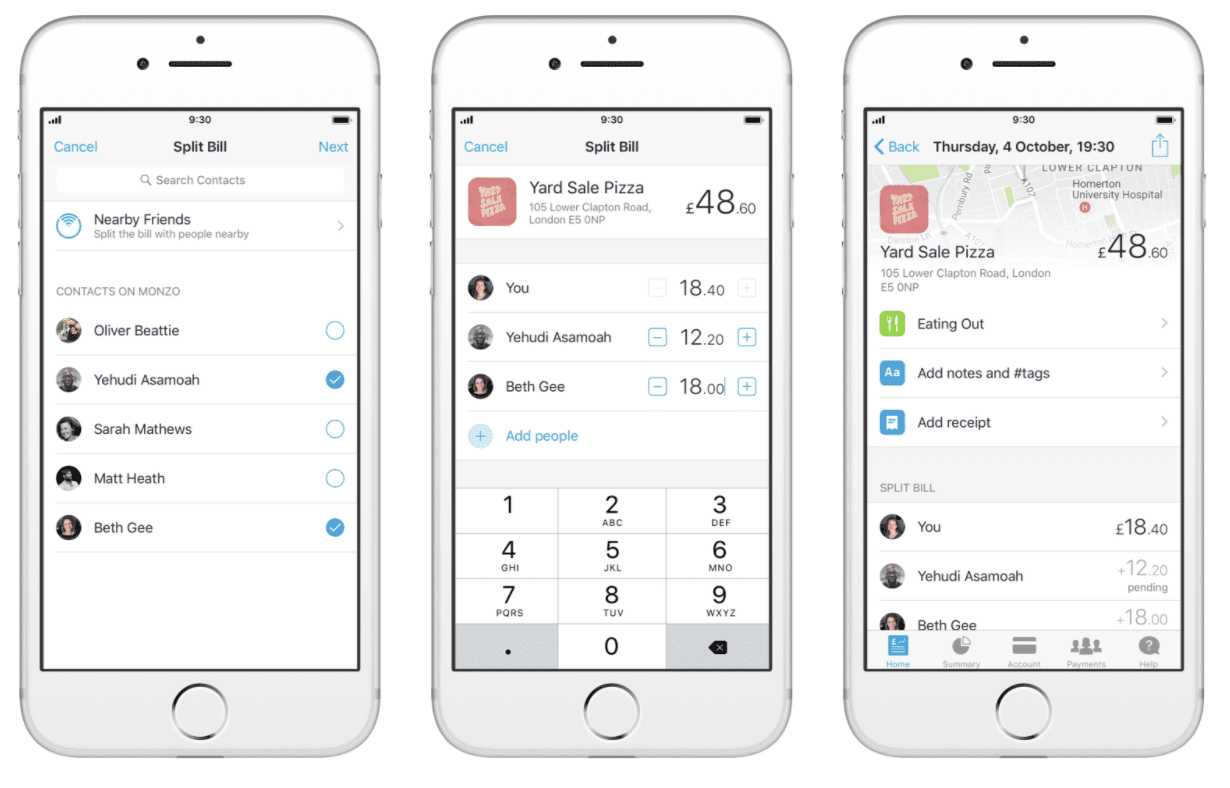

But I think that is starting to break down. That’s probably been the issue when it comes to the definition of fintech and its prevalence. It’s that cultural shift, and I think that’s starting to change. It’s becoming more acceptable to instantly split a bill with your friends. I keep bringing up the challenger bank example and the payments example when it comes to fintech, but it’s so powerful. There’s no longer any of this arguing.

I remember you’d go on holidays with friends, there’d be 14 of us around the table and everyones arguing about who will pay, some never want to pay, there would always be this very awkward dynamism, but now I’d say fintech has become established in that, especially when it comes to payments, I think that’s how most people think of it.

Splitting a bill with Monzo

And the other element is wealth management and opening that and democratising wealth management and lendtech to an infinitely larger population than have ever had access to it before. You now have your Wealthsimples and other fintech companies along similar lines. And banks are now using those technologies to allow those customers who wouldn’t have had that portfolio to finally start managing their wealth in an incredible way. I think that is the definition of fintech.

It comes down to education doesn’t it? As you said, if we don’t feel comfortable talking about money related matters then it’s harder to educate people. It also feels that when talking to friends from outside of London, for instance some of my friends in Bristol, a lot less people know about what they can do with fintech and the benefits of using a Monzo or Revolut card.

Doug Mackenzie: It’s interesting that you mention Bristol, which is I think the 5th biggest city in the UK. To me it’s very cosmopolitan and metropolitan but it shows that as soon as you leave the London bubble, fintech plummets.

I think fintech journalism is helping to improve that, but if it’s gonna take that leap it needs to finally find those use cases. The products need to separate the wheat from the chaff and give people the products they want, rather than products that are going to help banks operate in a quicker way and more cost-effective way than they would have 20 years ago if they had actually evolved digitally like a lot of other industries did.

I’m always more excited, especially from a video point of view, about stories like that affect the B2C or the customer rather than ways to help banks to operate better. But obviously that’s still important and goes hand in hand. I think fintech journalism, since it’s a very product focused story rather than an issue based story, is always going to rely on those product-related releases, much like tech journalism.

Do you reckon Covid is helping financial services companies finally take digitisation seriously, and do you think they will actually come out of Covid stronger?

Doug Mackenzie: Yes, 100%. I had two interviews where I specifically talked about this. One with the Mexican challenger Bank Klar and one with Nationwide Building Society here in the UK, the Head of Customer Experience Carole Layzell.

In Mexico, which is a cash-dominated society, Covid alone has changed the DNA of payments over there. It turned it from being cash to increasingly more digital. That’s the consumer side, but change has also happened in the banks. The CEO Stefan Moller told me they went from working in an office, occasionally using paper, to complete working from home and digitally within a day. I know that’s just a challenger bank, but it’s interesting they were able to action this within a day. And that says a lot about the technology, more than about the size of the institution.

On the other side, Nationwide, which has one of the largest retail banking branch sectors in the UK, Carole took a very different approach. She was very aware that it was increasing digitisation but also how much of a role having these occasional bastions of branches dotted around the country would have. Having that approach of providing to the community and knowing that people can go there. Because suddenly when you are furloughed, money becomes far scarcer, even if you are getting that money in and having that support network is going to be incredibly important. And they are working on having that same level of support digitally.

Doug’s interview with Carole Layzel from Nationwide

Covid is not only changing the way banks are operating, it’s changing the way cash and payments are being transferred and customer experience in a far quicker way than it probably would have happened if this pandemic wouldn’t have happened. It might have accelerated it half a decade, I think.

It’s funny how in different places we are sometimes in a kind of bubble. You mentioned in Mexico cash dominates society and we’ve discussed how in London people are increasingly getting used to fintech products and services. In Lithuania, some cafes don’t even accept cash, it’s card only.

You travel a lot and see all these different countries and how they use fintech, you are able to see the trends first-hand. What are the trends that you see in terms of the places you’ve recently visited, I know you’ve been everywhere from Baltics to Hong Kong?

Doug Mackenzie: To lead off where you ended. Hong Kong is really exciting. I would still argue that it’s cash-based, but there are so many different players there when it comes to using QR codes, and you still have card adoption as well.

It has a very established financial institution core. You have big banking players there offering debit cards. But you also have the younger generation that are banking with these Chinese companies, the Tencents, the Alibabas. And they are just using QR codes. That plays into a huge interesting trend.

If these private companies like WeChat have your details when you make a payment they are starting to create a social credit score from those payments. But because they are also the social network side of things, and chats are not encrypted, WeChat is offering its own credit score. That’s very exciting – and scary.

AliPay credit score. Black Mirror? Source: Quartz

They are reading their customers’ messages as well as their purchases. So not only are they getting a full perspective when it comes to payments but also your social life. Who you’re interacting with. Your WeChat credit score is based on your friends, what you buy, how you buy it, how often you buy it, and what you’re talking about.

That’s one reason why I think Asia, when it comes to fintech and payments and AI is going to be so fascinating. There is no privacy law in China effectively, or anything like that. The amount of data they can pull on an individual is so much more colourful than anything we can pull in Europe, Africa, Latin America or North America. As a result, the AI actioning that can take advantage of some of those inputs is going to be vastly more clever and can actually provide better financial services for those people.

Obviously it’s very scary because all we think about is ‘why would we ever offer up our privacy’ to for instance the state or WeChat. I think that’s why we’re going to see some really exciting technologies come out of Hong Kong and China when it comes to fintech because of how rich this data set is from AI.

It sounds like a Black Mirror episode.

Let’s move to another region altogether. What trends did you see in the Baltics? Was it the first time you visited Lithuania last December?

Doug Mackenzie: Yes, it was my first time in the region. I had only been on the other side to Finland and Sweden, but never down to the Baltics. It was very interesting to see. The biggest and most exciting trend there was how closely aligned the government was working in terms of coordinating and facilitating innovation.

This started all the way down from education, which we mentioned earlier in tha chat, to increasing not only fintech literacy, but also fintech adoption. Having that two-pronged approach was so refreshing to see. At Fintech Inn we saw various different members from the government having an input on to the industry and I hadn’t seen that.

I travel the world going to these fintech events and it was really refreshing to see a government so preoccupied with facilitating this particular industry that I’ve been working in for half a decade. As education increases in fintech we’re going to see some exciting things there.

Have you been to Latvia or Estonia? I would be interested in seeing how you would compare the Baltic countries, we’re a small region, but with interesting fintech companies and innovations in each of the three countries.

Doug Mackenzie: I haven’t been yet, but they are on the list. It’s probably going to be more of a summer trip than a winter one, it was freezing last time in Lithuania.

What about Western Europe? Obviously the UK is a, if not the, leader globally. But you’ve seen so many other places and have the ability to look at things from a topline view. What sets us apart in Western Europe?

Doug Mackenzie: I don’t want to sound proud. If I was to follow my own earlier statements that fintech is really categorised by the payments and wealth management scene, payments in the UK is probably more advanced than the rest of Western Europe.

Germany is still very cash-dominated, Netherlands is dominated by Maestro, if you don’t have a Maestro it can be difficult to get money out of an ATM. I think the ubiquity of having these fintech banks based in London, obviously Revolut is also in Lithuania, but having them started up here, including Wealthsimple and all the wealth management companies as well, creates a sense of loyalty.

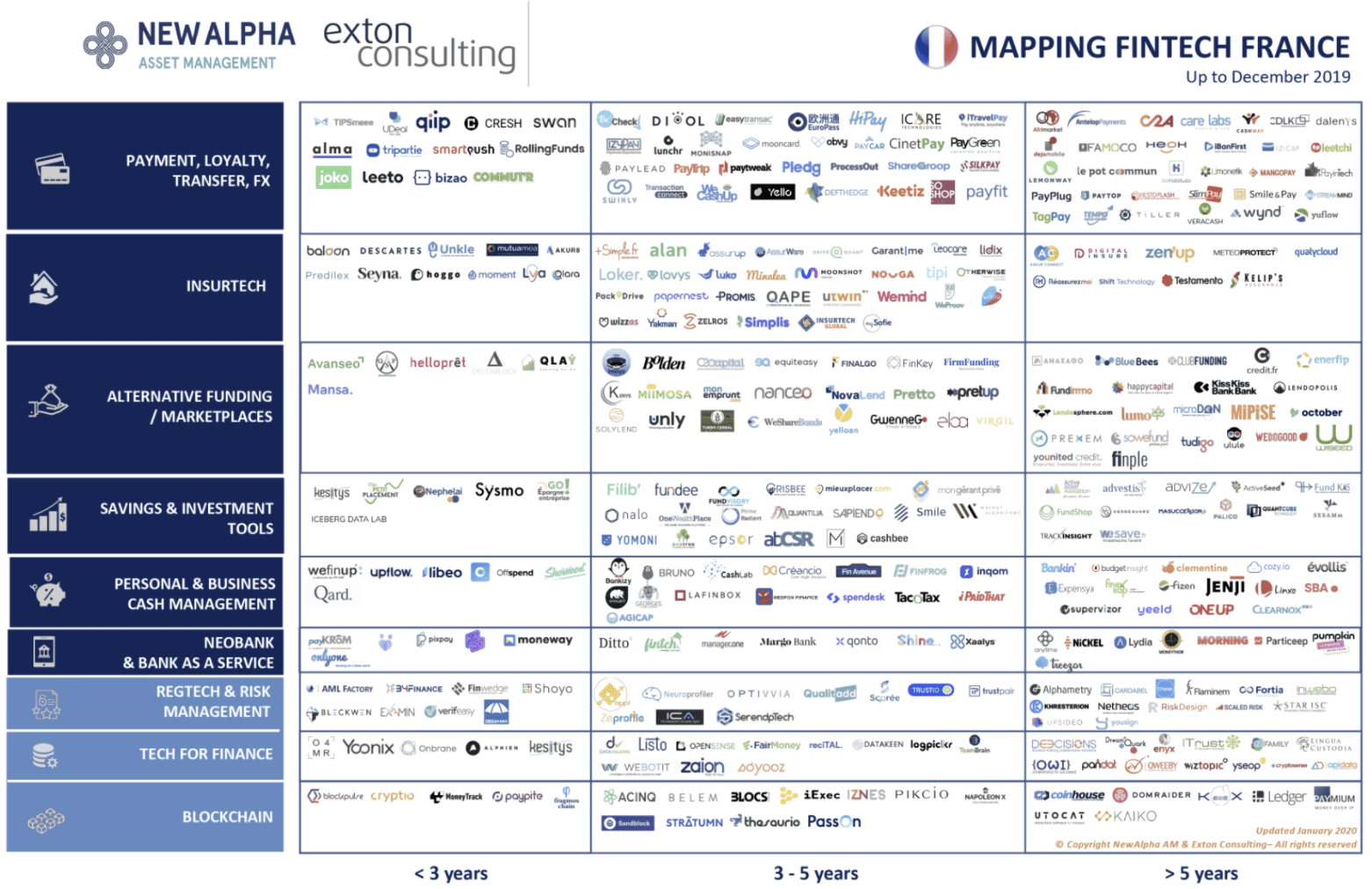

There are a lot of exciting fintech companies in France actually. I think they just need a bigger adoption from the large financial institutions in France. Whereas a lot of the big banks in the UK have actively looked to catch up to these fintechs. If you were to look at Northern Europe and consider that a part of Western Europe as well, Norway and Sweden when it comes to payments, especially, are leaps ahead.

Map of fintech ecosystem in France. Source: mappingfintech.com

I had an interview with a banker in Denmark and he was bemoaning having to teach his very young child that money doesn’t grow on trees. Until a very late stage children there apparently believe that all you have to do to buy something is press a button on an iPad, or tap a card and you get it. They had no concept of actually having to transact and losing, losing that cash that a child in other countries may have kept on to in a piggy bank or something like that.

Which brings us back to education. I wish at school we had had personal finance there and that somebody had told me to put aside 10% of my income away every month for a house or something.

So, what other exciting countries stood out for you? Which one fascinated you the most, and in which one can fintech have the most impact?

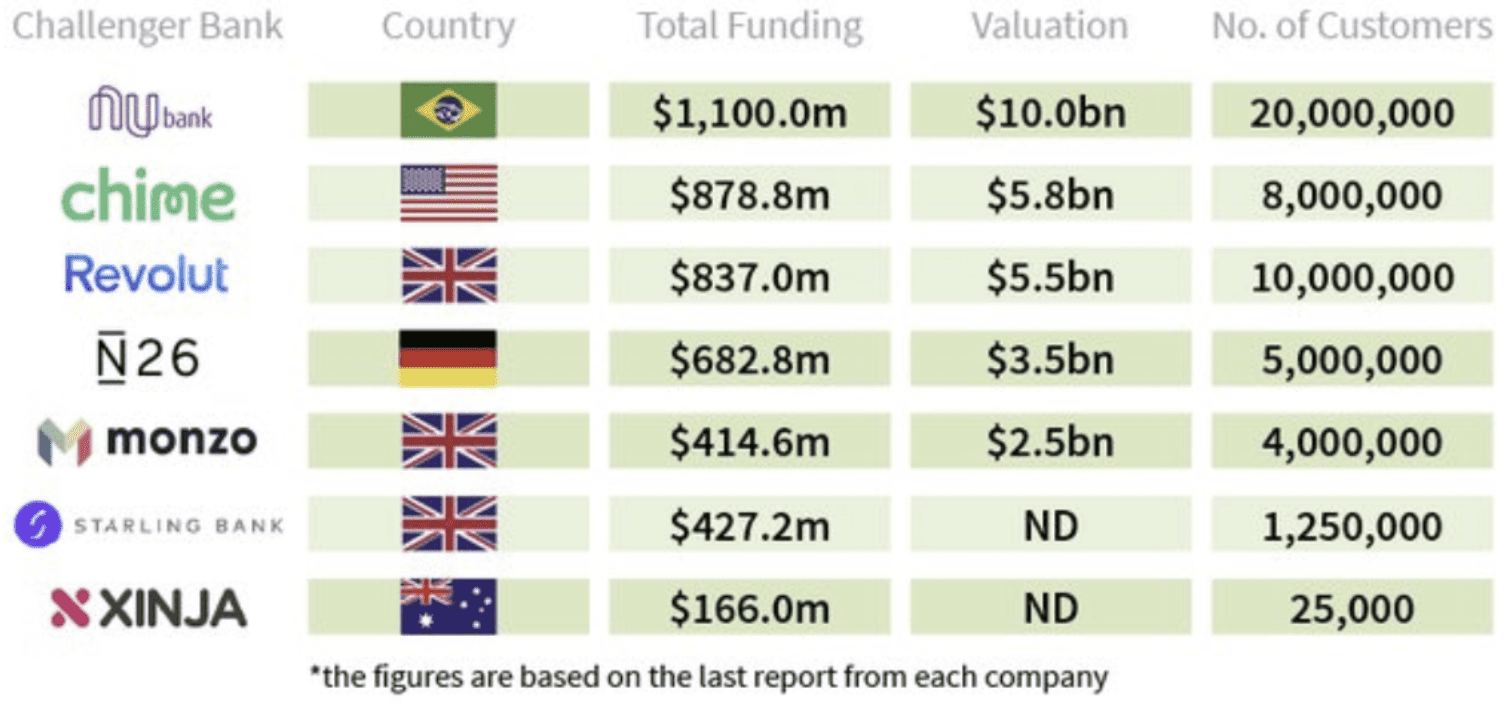

Doug Mackenzie: I think when it comes to Latin America, Brazil has some huge challenger banks that have a user base that is extremely vast. And that is changing the dynamism of that ecosystem. Now the institutional banks like Bradesco are having to think about it.

I visited Brazil and didn’t see any crime, but I hear there is a lot of pickpocketing and stuff like that. So it’s a huge change having these digital options. And I think that’s going to be increasingly popular. Brazil, when it comes to challenger banks, will be really exciting.

Overview of main challenger banks globally. Source: FinTech Global.

What interests me the most is China, because of what can be pulled out from the data sets. It’s not going to be replicable in any other ecosystem because of the privacy laws around the world. From a purely sci-fi perspective I’m interested in seeing where that goes.

From a very selfish perspective I want to see where the UK takes banking here, considering a lot of fintech companies are based here. Maybe some of the steam has slowed down because of Corona. When I started a lot of people were saying ‘Oh the fintechs are going to make the market share’. The banks had not digitised yet and everyone was in panic mode. Now, in February-March, I was going to banks, going to NatWest and they were completely calm. They were like ‘we’re happy to work with fintechs, bring it on, we’re excited, we have our own teams here as well’.

So I think this collaborative approach rather than conflict approach is very exciting for such a small industry. I mean, how many banks are there? Compare it to the number of players in other industries.

This is something I didn’t plan to ask with Covid going on, but what about Brexit? You mentioned loads of fintech companies are based in the UK, major players and challenger banks. We work with fintechs from the UK and across Europe and what we see is that British fintechs are thinking about where they could potentially go, simply because they were scared.

Do you think it will change much, because in the end it kind of feels like not that much will change given how important the UK already is for finance and fintech?

Doug Mackenzie: It’s such a huge topic. I think what started out as something scary, you saw so many large institutions moving sections of their business to Ireland. I think Ireland and Amsterdam in particular are going to do very well out of it. But one thing that is also not talked about too much is the significant heritage the UK has when it comes to finance and the fact that the strength of London, to the detriment of the rest of the UK probably, is that you can go to every bank within three streets. And that’s definitely not going to change.

What might change now because of Covid is that congregation of people in one place. Suddenly having that smaller market because the UK might have different regulations to the rest of Europe could be something to play. But I think at the end of the day the UK and its heritage when it comes to finance are a huge strength. And it’s certainly visible there how in a very short space of time fintech is being uttered by the average person on the street.

It shows that here the regulator is going to continue carrying out that role of being a trend-setter. I shouldn’t comment too much on Brexit. But I do think that, at the end of the day, it might come out, in this industry in particular, quite successfully for the UK because of its heritage and the fact that the UK government is so obsessed with finance. The government wants to make sure it is the most competitive, the most innovative globally, and they’ve never been afraid of taking risks. You can see that from the FCA throughout many years of innovation.

What trends do you see playing out in the future, post-Brexit or post-Covid? What exciting developments can we look forward to, from what you are seeing in the pipeline?

Doug Mackenzie: This is one thing I was sad to hear from a lot of institutions. I don’t want to name names, but it’s effectively back-pedalling now. We saw a lot of innovations planned for this year for a lot of organisations. You suddenly have to look at what’s realistic, what’s something we can attain, and it’s probably going to be a reduction of things.

We’ve seen it for instance in Monzo’s scaling out West, their manifest destiny, effectively the States, having to cut jobs there in Vegas. The expansion of fintech may take a back seat. In fact we’ve seen onboarding numbers drop in various different banks. I think people are going to be less carefree with their money and maybe install less fintech apps. Not to sound from a too negative point of view, from an innovative side of things, at least in terms of innovation for innovation’s sake, I think we’re going to see that reduced.

What I think we’re going to see is innovation where things have probably been cemented years ago. The fact that now you can have someone to talk to about your money no matter what size budget you have. Customer experience is obviously going to become incredibly, incredibly important as a result of Covid.

When it comes to working with PRs, businesses and agencies. We’ve spoken to digital journalists who get pitched with hundreds of emails. How does it work for you as host and producer, do you also get hundreds of emails every day?

Doug Mackenzie: Yes, we do have that written side of things, and we do have a magazine as well.

I do get pitched, probably it’s nowhere near as much as the writer journalists that you had before. I had a holiday the other day, and just in terms of PR companies trying to get the story out there, it was 50 within the first half of the day. That’s not including the ones you get on LinkedIn or WhatsApp.

People pitch me on LinkedIn, not as much as on email. Previously it used to be a bit over the phone. But now it’s WhatsApp. We do get a lot of stories pitched. It’s hard, because as I mentioned at the beginning of the webinar, it’s a very product-driven thing. Finding a story within that can be difficult.

Hopefully as fintech becomes more universal, democratised, we will begin seeing more of those stories.

How many of the emails you receive every day do you find relevant?

Doug Mackenzie: Does it sound mean if I say one or two?

Nope, that’s totally fair. Also I’m surprised LinkedIn seems such an important channel to pitch you, how do you find that? Is it because people get through to you quicker?

Doug Mackenzie: In terms of LinkedIn, I actually prefer it. I think people like people. We met earlier in Lithuania. When I get an email from you guys it immediately catches my eye. I think when you go on LinkedIn, there is a face attached to it and other information. You can still have that instant connection, and you don’t have to click on the link to see those first couple of lines about them.

However, some of the messages I get on LinkedIn are people saying stuff like “Our companies have very similar portfolios. Let’s get discussing.” And I’m thinking ‘what’. I’ve never met you and “discussing” what? There are so many questions about this, that you just gotta say “No, I’m out”.

Despite that, when the messages are straight to the point and have that face attached to it, it can be quite successful.

There are so many fintech startups and new ones appearing. So many CEOs, founders. Is there a secret ingredient to catch your attention? What can new companies do when they are starting out, if they have no fancy track record, or no big deals coming up? What are you looking for in a startup if you are deciding whether to cover them?

Doug Mackenzie: For me it’s always mass appeal. Fintech can be a very niche audience. The stories aren’t always compelling as a result. They might only be affecting a small number of people. The transfer between two large banks is now sped up in a more regulated way. Hooray! Great, it’s important and it’s necessary, but when you see an application that can be used and be interoperable around the world, when you think “I’m gonna be able to travel the world, use this application to make my life easier, make my friends’s lives easier” and ultimately make money easier and safer for everyone around the world – those are the stories you live for.

If you can capture that imagination I think that’s the key. Not too sound to overly imaginative about the industry, ha. It’s about the impact it will have on people.

We do have some attendees that are not from the UK. Obviously the UK is so important in terms of fintech (and startups generally) that all the important fintech publications are predominantly located there. For companies around the world and Europe making it to a UK publication is a big deal.

But when you are a small startup from outside the UK, whether from the Baltics, France or the Netherlands it’s harder. UK startups have an edge in terms of relevance for you guys. So, what can non-UK startups do to get your attention?

Doug Mackenzie: It does feedback on what we mentioned just then – the interoperability of the product or the service. If it can be applicable to various different geographies that’s huge. If it can’t but it’s really, really important for that one area, it still can be very interesting. Obviously it then has to follow that exponential importance to geographical interest.

We cover QR codes all the time, even though I haven’t used one in 5 years. Because we know that most of Central, East Asia use QR codes for making transactions. I think a strength of Fintech Finance is the fact that we do travel the world and we do tend to cover a lot of different geographies, but I think it’s really trying to find that story, and making it a very human story. Explaining how in that culture or in that geography it is a really big issue. Going back into that human element, rather than the product element, that already speaks volumes. And I’d love for the industry to go far more into that than just products.

Questions from the audience.

Why do you think fintech media is so concentrated in London? Why have not more fintech outlets taken off in other parts of the world?

Doug Mackenzie: I’m sounding like an advert for London throughout this webinar, I do apologise. Maybe it is as we said previously, English is the lingua-franca. It started off with Worldpay in the end of the eighties, and obviously the challenger banks here.

It’s just having that established connection and the fact you can talk to various different institutions immediately. You then get the impact, the fact that the article can be exported worldwide, because it is in English. You get the American market that can tap in and exponentially you’re getting more viewership, so I think that was very important.

I have seen a lot of French fintech media and that’s probably because of the strength of the French language, French has been exported around the world. Probably after English publications, French publications are second.

Given that challenger banks are digital-first, why do you think Revolut, Monzo and N26 are not doing that well in the US currently?

Doug Mackenzie: Firstly, regulatory. The US has 50 different regulators for the country. Also, as we discussed earlier, I’d argue that the ecosystem of American payments is laggard. It still has a supreme addiction to cash. Last year I was in Virginia just outside Washington DC and I saw a sign saying “Chip & pin coming soon”, as a celebration.

At another place, a POS terminal had the label offering contactless, so I did tap my card. The seller was so taken aback that he almost didn’t believe it and he almost didn’t accept the payment. Even the receipt came out and everything. He had no idea about contactless.

Obviously these are anecdotal, but the American payments landscape is frustrating. It might be again a case of education. At least in New York hopefully we should start to see a bit more success.

Even in Spain, you can jump on a cab and everyone takes contactless. I guess that’s the strength of the European Union, having that unified, codified regulatory approach to things. Suddenly you can go across borders and there is no issue, you’re absolutely fine. But between two US states it might not be as easy. From our point of view here, starting up a company there is probably incredibly frustrating.

What are your thoughts on open banking in the next 1-2 years?

Doug Mackenzie: I’m very excited by it. I’m sad that some of the higher end innovative ideas aren’t going to come to fruition from the large banks or challenger banks as everyone looks to minimise the loss from Covid, but I still think there is a place for open banking. And it’s going to really start helping critical services that have probably need to be helped in financial services for ages.

I think a lot of companies are looking towards each other for help now and thinking how they can work together. You only have to look at adverts from banks nowadays, they are all talking about sticking together. In the UK it’s almost incessant, you get an advert every three minutes on TV or on YouTube. These home-esque adverts of banks saying “let’s stick together, we need to help each other”.

I think that will be interesting, going from a combative nature to finally embracing open banking, which a lot of banks have talked about but maybe haven’t actually fulfilled. So hopefully that collaborative approach will finally become a thing.

What was your favourite interviewee or most exciting conversation you had and why?

Doug Mackenzie: It’s a difficult question. To put it in perspective, we do a lot of event coverage and when we film at an event my Director doesn’t like to do under a hundred interviews in the course of the event. So I can typically be speaking to anywhere around 25 people on camera every day.

I guess recently, with Covid, it might have been my interview with DBS over in Hong Kong, going back to that China side of things and hearing how it’s effectively a blank slate over there. You know, Corona happened but they can just effectively move on from that and continue. That was with Medhy Souidi who is the Head of Fintech and ‘StartupXchange’. It’s his job to source the fintechs, take them through the entire bank and then hopefully make a value use case to bring them in, so a really exciting interview to hear. He’s someone who has to keep their ear on the ground to new technologies but also then help the fintechs actually make it, rather than bring them in they fall to the wayside and that’s the end of it.

He’s a good guy as well, so hopefully we’ll start seeing some interesting fintechs coming out of DBS, which is already such a digitally native bank effectively. And they are already so good when it comes to innovation in Singapore. It was absolutely brilliant.

What are your next destinations once Covid is over? When are you going to visit Estonia, the birthplace of a lot of new and exciting fintech startups?

Doug Mackenzie: I’d love to go see Estonia. But pre-existing documentaries that we had lined up still need to be fulfilled, so for the next interviews we got, we got San Francisco, South Africa, Ghana, France and then Indonesia. And that’s just the weeks as soon as lockdown goes. So I’m very excited for it.

I looked slightly miffed there, remembering I would have to leave my little housy bubble I got going on here, but I’m so excited. I think we’ll be speaking to hopefully Gojek, the app that has effectively allowed an island nation the width of the United States, mom and pop corners shops, be able to transact via card, use their services digitally, so I’m really excited for that one.

I’m also really excited to go to Sub-Saharan Africa because of Mpesa and the phone adoption there when it comes to payments.

Thanks so much for the chat Doug. What is the best way to reach you, stay in touch with you and follow your journey travelling around the world?

Doug Mackenzie: I’m probably gonna kick myself for saying this, but being quite a gregarious person I like to chat with people. Normally it’s pretty easy to get our phone. Give us a ring, if the story is interesting enough people will want to actually say it on the phone. It’s easy to write a boring story in an email and send it over. But actually if you can talk about it and get us interested about it at the start, then that’s a huge amount of legwork gone.

Also LinkedIn. Always put a face to a name and attend events. That’s where we started off and made our name. We pretty much attended a fintech event every other day. It did help being in the UK where a lot of fintech events are always happening.

Every other day we were not travelling, we were in a fintech event and we filmed everyone there. So if you’re at an event you will probably get seen by someone. Obviously events are a bit in the back-burner right now, but that’s the idea, face-to-face interaction.

The best way to watch our stuff is fintechf.com or YouTube. To stay in touch with me personally LinkedIn would be the best place.

More from our Journalist’s Insights series:

Securing media placements during COVID-19 with Yessi Bello-Perez from The Next Web

Journalist’s Insights: From PR to Media With Remco Janssen of Silicon Canals

Breaking the Journalism Mould with Dan Taylor from tech.eu

Busting Journalism Myths with Lindsay Dodgson from Business Insider